If 2025 felt strange but manageable, 2026 is shaping up to feel different in a more meaningful way. The last few years rewarded simplicity: hold cash, earn solid interest, and rely on assumptions that mostly held from one year to the next. That playbook worked, and now it’s starting to break down. Rates, inflation, politics, and policy are colliding in ways that make this a year where paying attention matters more than being clever.

A Shift from Certainty to Uncertainty in Rates and Income

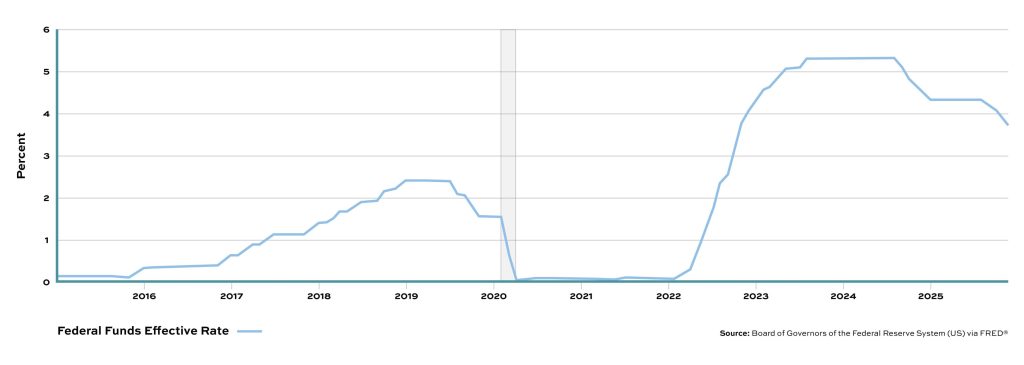

The story of the last few years was the speed and scale of rate hikes used to rein in inflation. After that rapid climb came a pause, then a few initial cuts. Now, we are sitting at a crossroads. The days of automatic, predictable rate moves appear to be behind us, replaced by a more reactive, data-driven approach from the Federal Reserve.

That shift matters for public entities because it makes interest income harder to count on. Not long ago, it was reasonable to say, “Last year’s income is a good proxy for this year.” In 2026, that is a much shakier assumption. Political pressure to lower rates, especially in an election year, adds another layer of uncertainty. Faster-than-expected cuts may sound appealing at first, but they can quietly erode income and reopen inflation concerns. The potential changes in Fed leadership only widen the range of outcomes, making it harder to plan with confidence.

Inflation’s Second Wave Risk and Conservative Budgeting

Most budgets have already felt the sting of the first inflation surge. The real concern now is what happens if inflation doesn’t stay contained. Once inflation takes root, it tends to spread, showing up across labor costs, services, insurance, and everyday operating expenses. At that point, it becomes far harder to manage.

That is why conservative budgeting matters more now than it did a year ago. Revenue projections need breathing room, and expense forecasts should acknowledge that inflation does not always move in straight lines. The relative calm of 2025 was helpful, but it may not be the best guide for what comes next.

Rethinking Investment Posture: From Flexibility to Intentional Structure

For a while, holding cash felt like the easiest win in the room. Short-term rates were attractive, liquidity was high, and there was little pressure to commit funds further out. That approach worked well, until the environment started to change.

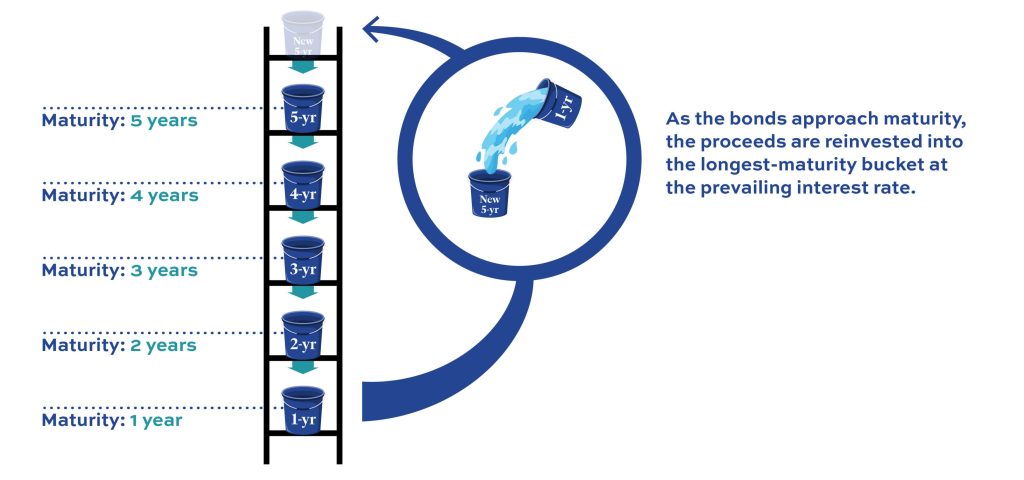

In 2026, staying entirely in cash introduces a different kind of risk. If rates come down, income drops immediately, with no offset. That is why gradually laddering a portion of funds into short- and intermediate-term investments is back on the table. This is not about calling the next rate move. It is about avoiding a setup where your entire income stream depends upon one variable.

A simple ladder can quietly do a lot of work:

- Keep liquidity where it is needed

- Smooth income over time

- Reduce reliance on a single rate environment

It does not require long commitments or perfect timing, just intention and follow-through.

Liquidity: A More Nuanced Definition in 2026

Liquidity often gets boiled down to one question: “How much cash do we have?” A better question is whether obligations can be met without being forced into uncomfortable decisions. For public entities investing in high-quality, dollar-denominated instruments, market liquidity is generally there when it is needed.

The bigger issue now is internal cash management. Large balances sitting in checking or overnight accounts can feel safe, but this comes with trade-offs in a shifting rate environment. Separating what is truly needed for day-to-day operations from what can be invested, even modestly, has become a more important exercise than it was just a year or two ago.

Policy Fragmentation and Localized Regulatory Risk

Markets are not the only source of uncertainty. Policy is becoming more fragmented, with states and local governments increasingly pursuing their own approaches to taxes, infrastructure, housing, and regulation. Those decisions often reflect local demographics and priorities, which means their effects can vary widely.

For local entities, this creates uneven outcomes. Policy changes may arrive quickly and land differently from one jurisdiction to the next. Property tax discussions, for example, could ease pressure in some areas while straining budgets in others. The challenge is not just the policy itself, it is the speed at which it can change conditions on the ground.

The Most Common Pitfall: Assuming Stability

One of the most common traps in periods like this is assuming that change will not make its way into the budget. In 2026, that is a risky bet. With rates, inflation, elections, and policy all in play, there are simply more variables than usual.

Being conservative does not mean standing still. It means stress-testing assumptions, building buffers where possible, and staying flexible enough to adjust without scrambling. Some developments will always be unpredictable, but many can be planned for with thoughtful scenarios and disciplined execution.

The Mindset for 2026: A New Playbook

If there is one idea worth carrying into 2026, it is this: this year will not look like last year. The strategies that worked when rates were high and income was predictable may not hold up in a more fluid environment.

The good news is that this does not call for dramatic moves. It calls for a bit more structure, a bit more caution, and a willingness to adapt. In a year where change is more likely than continuity, that mindset can make all the difference.

About Deep Blue Investment Advisors

At Deep Blue Investment Advisors, we specialize in helping government finance officers expand their horizons by diving into fixed-income management solutions with tangible results. Our team of experienced investment management professionals can help tailor a portfolio to your investment needs while providing regular reporting, portfolio compliance, and performance meetings. You can always count on us to prioritize our relationships, provide guidance, and act in your best interest.

To open an account or for more information, connect with one of our advisors today.

*This article is for informational and educational purposes only and does not constitute investment advice, an offer, or a solicitation to buy or sell any securities or to adopt any investment strategy. The views expressed are those of the author as of the date of publication and are subject to change without notice. While information contained herein is believed to be reliable, Deep Blue Investment Advisors makes no representations or warranties as to the accuracy, completeness, or timeliness of such information. Past performance is not indicative of future results. Investment decisions should be made based on the entity’s investment policy, statutory requirements, risk parameters, and overall financial circumstances.