Navigating the complexities of arbitrage rebate is crucial for any borrower involved in tax-exempt and tax-advantaged debt. Established by the Internal Revenue Code of 1986, these rules aim to prevent the abuse of tax-exempt borrowing — a subsidy from the federal government intended to be used responsibly.

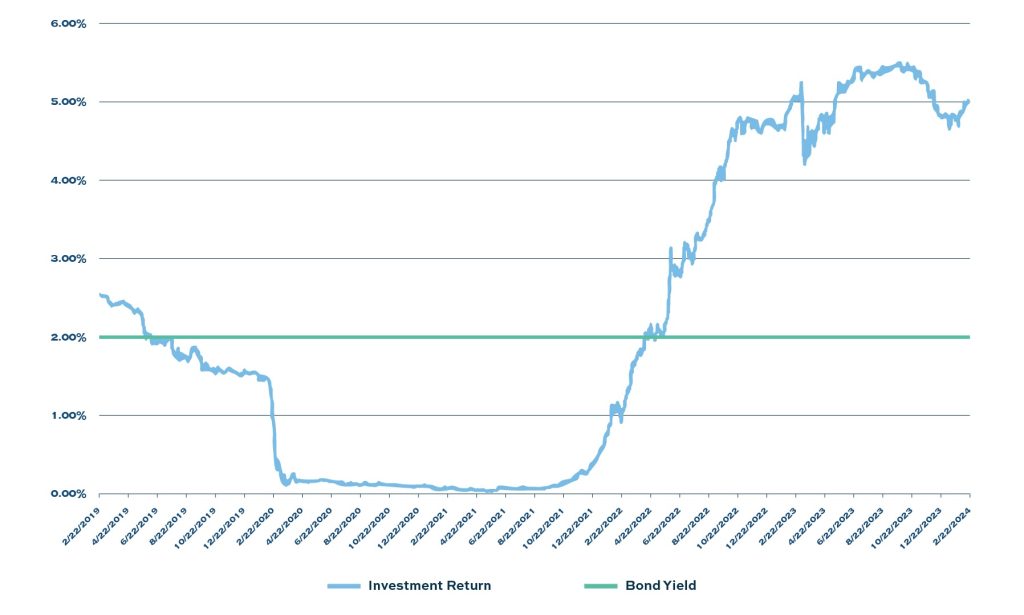

In recent years, the financial landscape has seen significant changes, entering a positive arbitrage environment marked by soaring interest rates. This shift has led to higher yields on taxable investments compared to tax-exempt borrowing rates, thereby increasing the amounts owed to the IRS.

Understanding Arbitrage Rebate Regulations

Arbitrage is the difference between the tax-exempt borrowing rate and the taxable earnings rate. When the earnings on investments exceed the borrowing rates — otherwise known as positive arbitrage — the dollar value of the excess earnings must be paid back to the IRS as a rebate.

Arbitrage rules were implemented to ensure borrowers do not:

- Borrow more funds than needed

- Borrow funds earlier than needed

- Borrow funds for a longer term than needed

These rules apply to all forms of tax-exempt and tax-advantaged debt such as bonds, notes, bank loans, and more. Non-compliance can lead to severe penalties, including the loss of tax-exempt status and significant financial settlements with the IRS.

Yield restriction is another critical component of arbitrage rebate regulations. Unlike rebate, which focuses on excess earnings, yield restriction mandates that gross proceeds cannot be invested at a yield materially higher than the tax-exempt borrowing rate. This keeps investment income within permissible limits, safeguarding the tax-exempt status of the bonds.

Confirming Compliance

To confirm compliance, borrowers must diligently track their bond yield and manage the allocation of proceeds. Properly categorizing these proceeds can help issuers maintain the tax-exempt status of their bonds and optimize their financial strategies. You should also meticulously track investments, earnings, and expenditures. This includes maintaining detailed records — from the date of issue through final maturity, plus three additional years — of bond transcripts, bank statements, expenditure receipts, investment earnings, and debt service payments.

At a minimum, the IRS requires rebate calculations every five years and at bond maturity. However, conducting more frequent arbitrage calculations can help stay ahead of compliance requirements. Annual calculations help identify potential issues and prepare for possible rebate or yield reduction payments. Calculations are cost-neutral in a positive arbitrage environment due to computation credit provisions.

Minimizing Payments: Special Considerations and Exceptions

Certain exceptions within arbitrage rebate regulations provide opportunities for you to minimize or even avoid rebate payments to the IRS under specific circumstances.

Bona Fide Debt Service Funds

According to Section 1.148-1(b) of the regulations, a bona fide debt service fund must:

- Primarily be used to match revenues with principal and interest payments within each bond year

- Be depleted at least once each bond year, except for a reasonable carryover amount

Small Issuer Exception

Governmental issues with an aggregate face amount of all tax-exempt bonds issued during a calendar year not exceeding $5,000,000 are exempt from the rebate requirement (though not from yield restriction).

Spending Exceptions

Borrowers can also plan to meet certain spending thresholds to retain excess earnings.

- 6-month: Spend 100% by the 6-month anniversary

- 18-month: Spend 15% by 6 months, 60% by 12 months, and 100% by 18 months

- 2-year: Spend 10% by 6 months, 45% by 12 months, 75% by 18 months, and 100% by 2 years

Understanding Expenditure of Proceeds

Reimbursement

Arbitrage regulations dictate the extent to which amounts spent prior to closing can be deemed paid from bond proceeds. Up to 20% of the bond issue’s proceeds can be allocated to preliminary expenditures incurred before the start of construction. These may include architectural and engineering costs, surveys, soil testing, and other preparatory expenses. However, land acquisition and site preparation costs typically do not qualify.

Capital expenditures outlined in an Official Intent Resolution, dated no earlier than 60 days before the resolution date, are also eligible for reimbursement from bond proceeds. Reimbursements must occur within 18 months after the initial expenditure, ensuring that the use of bond proceeds is appropriately documented and substantiated.

Current Outlay of Cash

Expenditures that contribute to the governmental purpose of an issue — including project construction costs, capitalized interest, and cost of issuance after closing — require a current outlay of cash. In these instances, it’s critical to ensure the investment records align with expenditure records.

Allocation

Upon completing your first required rebate calculation, your allocations are set in stone in the eyes of the IRS. When multiple sources of funds are used for a project, borrowers must employ a reasonable accounting method to allocate proceeds to expenditures. Common methods include specific tracing, gross proceeds spent first, first-in, first-out (FIFO), or ratable allocation.

Overall, positive arbitrage is not a negative, so long as you are aware of it. By understanding and adhering to arbitrage rebate regulations, you can optimize your financial strategies while maintaining compliance and preserving the benefits of tax-exempt financing.

About Deep Blue Investment Advisors

At Deep Blue Investment Advisors, we specialize in helping government finance officers expand their horizons by diving into fixed-income management solutions with tangible results. Our team of experienced investment management professionals can help tailor a portfolio to your investment needs while providing regular reporting, portfolio compliance, and performance meetings. You can always count on us to prioritize our relationships, provide guidance, and act in your best interest.

To open an account or for more information, connect with one of our advisors today.

*This Arbitrage Rebate article is for informational purposes only. This report is prepared by Deep Blue Investment Advisors (“Deep Blue”). Deep Blue makes no representation or warranty, expressed or implied, regarding the accuracy or completeness of the information contained herein. The report is not meant as a solicitation of any investment offered by Deep Blue. The US-FIT investments are not available for sale to the general public and only to certain qualified entities.

Investments in the US-FIT Pools are not insured or guaranteed by the FDIC or any other government agency. The investment pools may invest in fixed-income securities subject to risks, including interest rate, credit, and inflation. The investment return and principal value of an investment will fluctuate, so an investor may have a gain or loss when shares are sold.