Annual budgeting is one of the most important times of the year for public finance professionals. This process provides insight into the year ahead, allowing for confident navigation and circumvention of any upcoming financial obstacles. But when done right, budgeting sessions can illuminate revenue patterns that then create investment opportunities — making for more wiggle room and expanding the potential of public funds.

Cash flow forecasting for investing is a crucial yet commonly overlooked aspect of public fund management. This specialized approach enables government finance professionals to be more active and strategic with their spending, optimizing their investment strategies by balancing liquidity with returns.

It’s also a substantial undertaking requiring interdepartmental collaboration and clear communication. Below, Ken Couch, Director of Texas Business Development and Client Advisory Services at Deep Blue Investment Advisors, explores the strategic benefits of cash flow forecasting in public fund management as well as some tools for securing peer buy-in.

What Is Investment-Oriented Cash Flow Forecasting?

Discussions around cash flows are typically tied to budgetary processes and concerning operational funds. Distinguishing between general cash flow forecasting and investment-focused forecasting, therefore, is crucial. While cash flow forecasting identifies patterns in annual cash flow, applying an investment focus to forecasting finds opportunities in these patterns — allowing for more dynamic and strategic engagement with the market. Information for investment-oriented cash flow forecasting will be robust, requiring a minimum of 2–5 years of data from:

- Bank statements

- Pool statements

- Monthly investment statements

- Capital project spending projections

- Schedule of investment maturities and coupon payments

Identifying Investment Opportunities (and Breaking Free from the Budget Year)

Our firm’s stance is safety first, liquidity second, and yield third. Yet even we find that many entities choose to play it too safe. They remain overly liquid, missing out on potential yields by not utilizing investment ladders and more nuanced investment vehicles. But for some entities, the issue stems not from caution but from a lack of awareness that — depending on the position in the financial year — an organization may have investable funds. By redirecting focus from merely maintaining liquidity to actively monitoring investment cash flows, entities can significantly enhance their financial performance.

Cash flow forecasting and budgeting may be inextricably linked, but it’s important to note that investment opportunities are not confined to the budgetary year. Some funds will be limited to short- or medium-term investments, but others can provide opportunities for multi-year investing and strategic laddering.

The three types of funds are categorized by their utility and investment timeline:

- Liquid funds are immediately available for short-term needs.

- Cyclical funds may be tied up from three months to a year — ideal for creating short ladders during peak liquidity times.

- Core funds represent significant sums that consistently remain untouched, offering opportunities for longer-term investments.

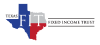

With these types of funds in mind, let’s forecast for a hypothetical municipal government. Using the chart below, we can pinpoint a cash flow peak in February and a valley in November.

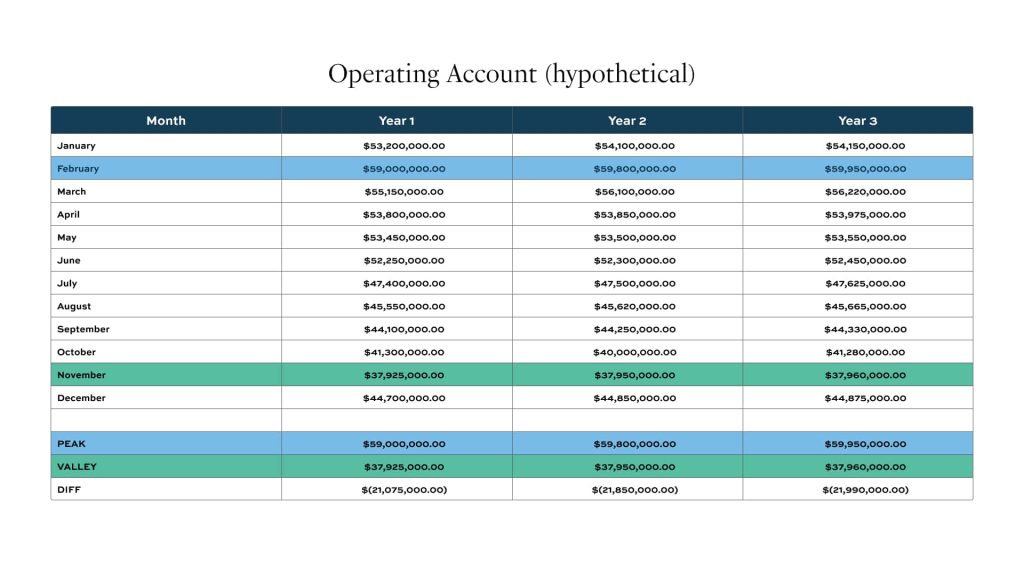

When we visualize these numbers on the chart, we can better understand the difference between our benchmark and our high-water mark — identifying the opportunities that lie within the two points.

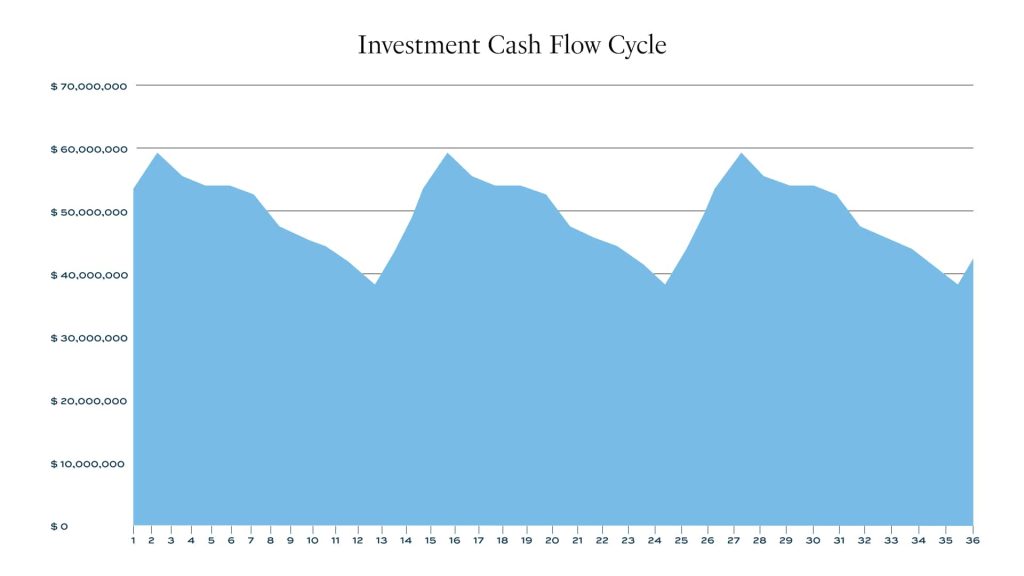

Lastly, we can combine our understanding of liquid, cyclical, and core funds to compartmentalize investment opportunities.

These visuals help us clearly communicate our point, but they’ll also help government finance officers communicate these investment opportunities and secure buy-in. In this example, our hypothetical municipality has core reserves nearing $40 million that can be safely invested in a 1-to-3-year or 1-to-5-year index, maximizing investment value. Approximately $15 million can be applied toward short-term investments that align intra-year cash flow with an optimized investment strategy. And the remaining $5 million can serve as short-term cash, fulfilling day-to-day obligations.

Implementing Laddering for a More Tactical Investment Approach

One of the best ways to maximize yield while minimizing risk is by laddering — investing funds to mature at different rates, both capturing favorable changes in interest rates and shielding from less favorable shifts.

Through Deep Blue Investment Advisors, this can be accomplished in two different ways:

- Using the pool products, investing in the Choice Pool from 2 to 12 months

- Using a managed account approach, extending duration by implementing a longer-term investment strategy of either 1 to 3 or 1 to 5 years (or longer)

About Deep Blue Investment Advisors

At Deep Blue Investment Advisors, we specialize in helping government finance officers expand their horizons by diving into fixed-income management solutions with tangible results. Our team of experienced investment management professionals can help tailor a portfolio to your investment needs while providing regular reporting, portfolio compliance, and performance meetings. You can always count on us to prioritize our relationships, provide guidance, and act in your best interest.

To open an account or for more information, connect with one of our advisors today.

*This Cash Flow Forecasting is for informational purposes only. This report is prepared by Deep Blue Investment Advisors (“Deep Blue”). Deep Blue makes no representation or warranty, expressed or implied, regarding the accuracy or completeness of the information contained herein. The report is not meant as a solicitation of any investment offered by Deep Blue. The US-FIT investments are not available for sale to the general public and only to certain qualified entities.

Investments in the US-FIT Pools are not insured or guaranteed by the FDIC or any other government agency. The investment pools may invest in fixed-income securities subject to risks, including interest rate, credit, and inflation. The investment return and principal value of an investment will fluctuate, so an investor may have a gain or loss when shares are sold.