For the past few years, the Federal Reserve has steadily raised interest rates to combat post-pandemic inflation, a process that has taken longer and has required higher rates than initially anticipated. This in part has led to an inverted yield curve, where shorter-term or cash investments have a higher yield than longer-term treasuries. However, we are reaching a turning point in the economic cycle — one that signals a shift toward rate reductions. As this brings new uncertainties, it is important to reassess investment strategies to navigate the changing financial landscape. While predicting Federal Reserve rate actions is an imperfect science, the outlook for rate cuts is becoming clearer.

Prepare for Rate Cuts

Weak economic indicators, such as slowing GDP growth, rising unemployment, and declining consumer confidence, point to a slowing economy. This increases the likelihood of the Federal Reserve implementing rate cuts to support economic activity.

- Inflation Concerns: If inflation remains subdued, the Fed has more room to cut rates without the risk of stoking inflationary pressures. Inflation remains a crucial factor, with recent data suggesting a mix of disinflationary pressures despite pockets of higher prices.

- Market Sentiment: Financial markets are forward-looking and often price in expectations of rate cuts before they are officially announced. This can be observed in the behavior of the yield curve and the performance of fixed income securities. Slow GDP growth or contraction signals economic weakness, prompting central banks to consider rate cuts to spur growth.

- Unemployment: weaker labor markets often lead to lower consumer spending and an economic slowdown, influencing central bank policies towards rate cuts.

- Consumer Confidence: lower consumer confidence can lead to reduced spending and slower economic growth, encouraging central banks to lower rates. Recent surveys indicate waning consumer confidence due to economic uncertainties and stock market volatility.

We are likely to see the start of a rate-cutting cycle in September, with further reductions throughout the year. Beyond that, the future is less predictable. While the uncertainty remains, the general trend points towards lower rates. This marks the beginning of a new cycle of decreasing interest rates.

The next election cycle will introduce new policies and fiscal issues that could impact the economy. As overnight cash rates decline, it is crucial to reassess our investment strategies. Moving away from a purely cash investment strategy and exploring options further along the yield curve will become increasingly important.

Protecting Yield

For operating funds that not needed past a six-month time horizon, extending into longer-duration investments, including Local Government Investment Pools, can be a prudent strategy to help lock in higher relative rates of return over the course of the next year. Taking advantage of these yield opportunities before potential Fed rate cuts is advantageous.

Adjusting Investment Strategy

With the likelihood that short-term cash will no longer be the highest-yielding option, it is an ideal time to evaluate the role of cash holdings.

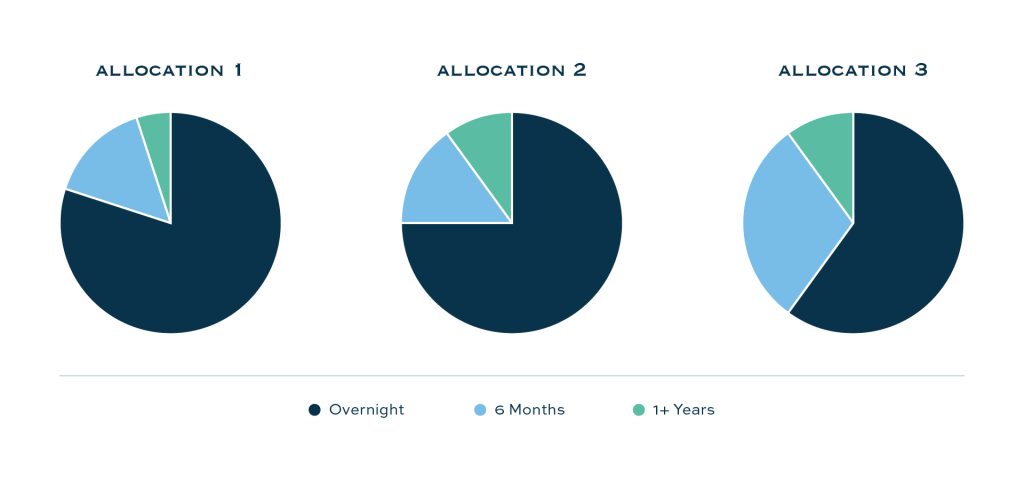

- Segment Your Cash: Depending on unique circumstances and needs, consider what cash you can set aside for a longer time. Instead of leaving all funds in cash accounts, segment your cash holdings based on immediate and longer-term needs.

- Explore Higher-Yield Alternatives: Short-term treasuries, commercial paper, and certificates of deposit often pay more than overnight money market funds. Locking up funds for a slightly longer term can yield higher returns, as well as longer-term investment pools.

- Diversify Your Allocation: Aim for a diversified strategy that balances liquidity with higher yields. By stratifying funds into different maturity and duration buckets, based on budget needs, a blended overall investment may produce higher overall portfolio yield. While being mindful of budget needs relative to the time horizon, a blended investment strategy over the longer term is prudent.

Seize the Opportunity

The markets and experts are aligned, indicating a high probability of upcoming rate cuts. Investors who can strategically extend a portion of their funds beyond six months, whether in individual securities or pooled investments, stand to achieve relatively higher returns. Those who can exercise patience and strategic planning during this period can be rewarded over time.

We recognize this crucial moment and want to ensure our investors and pool participants are well-informed and prepared to take advantage of this opportunity. If you already have an account with us, the operational overhead for this strategy is minimal. There is no need for a custodian, an internal investment specialist, or additional reporting requirements. Do not let this chance slip away — reach out to us to discuss how you can best navigate these changes and maximize your investment potential.

About Deep Blue Investment Advisors

At Deep Blue Investment Advisors, we specialize in helping government finance officers expand their horizons by diving into fixed-income management solutions with tangible results. Our team of experienced investment management professionals can help tailor a portfolio to your investment needs while providing regular reporting, portfolio compliance, and performance meetings. You can always count on us to prioritize our relationships, provide guidance, and act in your best interest.

To open an account or for more information, connect with one of our advisors today.

*This investment positioning article is for informational purposes only. This report is prepared by Deep Blue Investment Advisors (“Deep Blue”). Deep Blue makes no representation or warranty, expressed or implied, regarding the accuracy or completeness of the information contained herein. The report is not meant as a solicitation of any investment offered by Deep Blue. The US-FIT investments are not available for sale to the general public and only to certain qualified entities.

Investments in the US-FIT Pools are not insured or guaranteed by the FDIC or any other government agency. The investment pools may invest in fixed-income securities subject to risks, including interest rate, credit, and inflation. The investment return and principal value of an investment will fluctuate, so an investor may have a gain or loss when shares are sold.