On May 16, 2025, Moody’s Ratings downgraded the U.S. sovereign credit rating from Aaa to Aa1, aligning with S&P and Fitch and ending the nation’s triple-A status across major agencies. As fixed- income investors, you may wonder how this affects your portfolios and the broader market. Below, we provide an overview and initial thoughts.

A Brief History of U.S. Credit Rating Downgrades

The U.S. long held Aaa/AAA ratings from Moody’s, S&P, and Fitch, reflected its economic dominance, the dollar’s reserve currency status, and unparalleled Treasury market depth. While these fundamental strengths remain, growing fiscal pressures and political gridlock have prompted the three major rating agencies to reassess their outlook, resulting in downgrades.

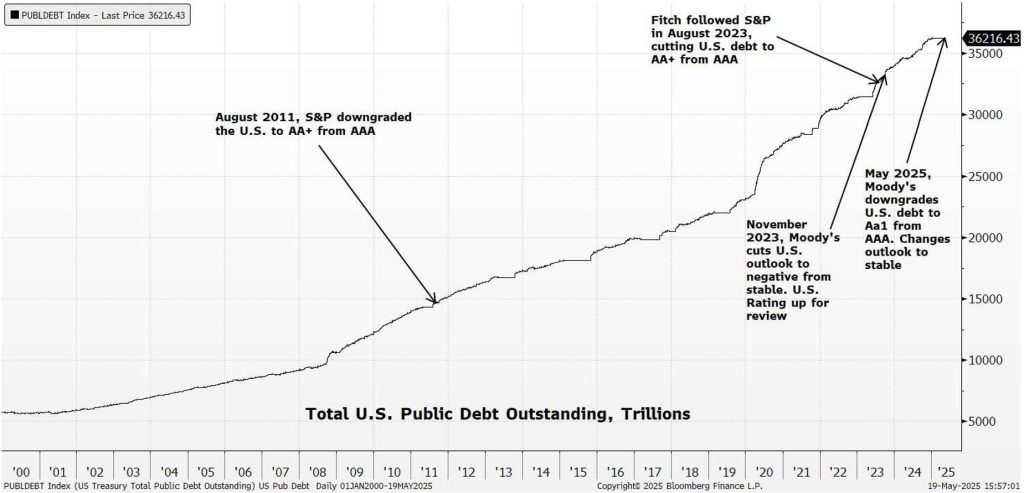

S&P Downgrade (2011): In August 2011, S&P downgraded the U.S. to AA+ amid a contentious debt ceiling standoff that nearly triggered default. The move, driven by rising deficits and political dysfunction, shocked markets. Treasury yields oddly enough, fell as investors sought safety, underscoring U.S. debt’s safe-haven status despite the rating cut. The national debt then stood at $14.7 trillion, a sharp rise from $10 trillion in 2008.

Fitch Downgrade (2023): Fitch followed in August 2023, cutting to AA+ after another debt ceiling crisis, worsened by House Speaker Kevin McCarthy’s departure. Fitch cited fiscal deterioration – a debt-to-GDP ratio nearing 95% and governance issues. Market reaction was muted; 10-year Treasury yields rose modestly from 4% to 4.2% over weeks, driven more by increased issuance/market dynamics than the downgrade. Debt had climbed to $33 trillion.

Moody’s Downgrade (2025): Moody’s, which held a Aaa rating since 1919, shifted to a negative outlook in November 2023 before downgrading to Aa1 on May 16, 2025 after the market close. This move, long anticipated, aligns Moody’s with its peers, reflecting fiscal trends already priced into markets. Moody’s upgraded the outlook to stable from negative.

Why the Downgrade Now?

Moody’s cited a decade-long decline in fiscal metrics, outpacing other highly rated sovereigns:

Rising Debt Burden: Federal debt reached $36 trillion in 2024, with a debt-to-GDP ratio of 98%, projected to climb to 134% by 2035.

Soaring Interest Payments: Interest costs absorbed 18% of federal revenue in 2024, up from 9% in 2021, and are expected to reach 30% by 2035.

Persistent Deficits: Federal deficits, at 6.4% of GDP in 2024, are projected to widen, reaching nearly 9% by 2035, driven by rising entitlement spending and flat revenue.

Policy Inaction: Successive administrations and Congress have failed to curb spending or raise revenue, with partisan gridlock stalling fiscal reform.

Moody’s assigned a stable outlook, citing the U.S.’s economic scale, the dollar’s reserve currency status, and effective monetary policy led by an independent Federal Reserve, suggesting no further downgrades soon.

Short-Term Impacts: What to Watch

Money Market Stability: For LGIP clients, your AAA-rated funds/money markets remain unaffected. These funds, governed by the SEC, maintain strict credit quality, diversification, and liquidity standards to ensure principal stability. Their AAA ratings from Moody’s, S&P, and Fitch are based on portfolio quality and risk management, not the U.S. sovereign rating, and remain intact post-downgrade. Historical downgrades (2011, 2023) similarly had no impact on money market fund stability, reinforcing their resilience.

Treasury Yields: The downgrade briefly pushed yields higher across the interest rate curve, with the 2- year treasury yield topping 4% and the 10-year treasury yield reaching 4.56% in early morning trading. As market participants digested the widely anticipated news, consensus prevailed that the downgrade was unlikely to drive major shifts. By day’s end, yields retreated to pre-announcement levels.

Market Sentiment: Volatility spiked in early trading on May 19th, but quickly settled, reflecting the downgrade’s limited surprise factor. Analysts view it as a “formality,” given Moody’s lag behind S&P and Fitch. While fiscal concerns persist, Treasuries remain the world’s premier collateral, ensuring demand despite the rating cut.

Our Take:

For DBIA clients, the Moody’s downgrade should have a minimal impact on your money market and fixed-income holdings in the short to medium term, as Treasuries and agency securities retain their safe- haven appeal. Over the longer term, large deficits, a $36 trillion debt load, and rising interest expenses – projected to consume 30% of federal revenue by 2035 – may lead investors to demand higher yields on new Treasury issuances, potentially increasing borrowing costs. For now, impacts remain limited, and we will continue to closely monitor fiscal policy and market dynamics to ensure your portfolios remain resilient. Please reach out with questions or to discuss your specific portfolio.

Contact Information

| Ben Streed, CFA | Chief Investment Officer | Benjamin.Streed@deepblue-inv.com | 813-440-5088 |

| Dan Marro, CFA | Portfolio Manager | Dan.Marro@deepblue-inv.com | 813-321-3253 |

| Vito Resciniti | Market Strategist | Vito.Resciniti@deepblue-inv.com | 813-556-9774 |

Disclosures

This presentation is only intended for institutional and/or sophisticated professional investors. This material is intended for informational purposes only and should not be relied upon to make an investment decision, as it was prepared without regard to any specific objectives, or financial circumstances. It should not be construed as an offer or to purchase/sell any investment. Any investment or strategy referenced may involve significant risks, including, but not limited to: risk of loss, illiquidity, unavailability within all jurisdictions, and may not be suitable for all investors. To the extent permitted by applicable law, no member of the Deep Blue Investment Advisors Team and/or US-FIT Trust or any officer, employee or associate accepts any liability whatsoever for any direct or consequential loss arising from any use of this presentation or its contents, including for negligence. This material is not intended for distribution to, or use by, any person in a jurisdiction where delivery would be contrary to applicable law or regulation, or it is subject to any contractual restriction. No further distribution is permissible without prior written consent.

The views expressed within this material constitute the perspective and judgment of Deep Blue Investment Advisors and/or US-FIT Trust at the time of distribution and are subject to change. Any forecast, projection, or prediction of the market, the economy, economic trends, and equity or fixed-income markets are based upon current opinion as of the date of issue and are also subject to change. Opinions and data presented are not necessarily indicative of future events or expected performance. Information contained herein is based on data obtained from recognized statistical services, issuer reports or communications, or other sources, believed to be reliable. No representation is made as to its accuracy or completeness.

Performance data quoted represents past performance; past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. The current performance of the fund may be lower or higher than the performance quoted. Although US-FIT seeks to preserve the value of the investments at $1.00 per share for the pools with the “stable NAV” type, there is no guarantee that this will be achieved. Investments in the US-FIT Trust are not insured or guaranteed by the FDIC or any other government agency.