November marked the end of the longest government shutdown in U.S. history, lasting 43 days, ending with President Trump signing a bipartisan continuing resolution bill to reopen federal agencies and fund operations through January 30, 2026. Even though the shutdown ended mid-month, the volatility and uncertainty carried through November. Intense pressure mounted to resolve the gridlock as over 40 million SNAP recipients faced benefit lapses, an estimated 670,000 federal employees were furloughed, and another 730,000 worked without pay, straining household budgets and local economies. Air travel disruptions peaked with up to 6% of flights canceled or delayed due to understaffed air traffic controllers/TSA agents, a figure that was projected to climb to 10% in a matter of days had the stalemate dragged on.

Despite the government’s reopening, the data blackout persisted: The Bureau of Economic Analysis canceled the Q3 GDP estimate, and the Bureau of Labor Statistics confirmed October’s jobs report would go unpublished – depriving markets of a critical gauge amid some FOMC members’ recent pivot, placing greater weight on labor market conditions over inflation given the last three available nonfarm payrolls averaged under 30,000 jobs per month. Additionally, the November jobs report, typically out on the first Friday of December, is delayed, though not all releases are off the table as private sector proxies and select metrics (like weekly initial and continuing claims) offer partial glimpses. Over the month, the 2-year Treasury yield rose from 3.53% to 3.57%, while the 10-year yield fell from 4.09% to 4.07%. Both saw significant intra month volatility reflecting flight-to-safety flows and recalibrated bets on Fed easing amid the fog of incomplete data.

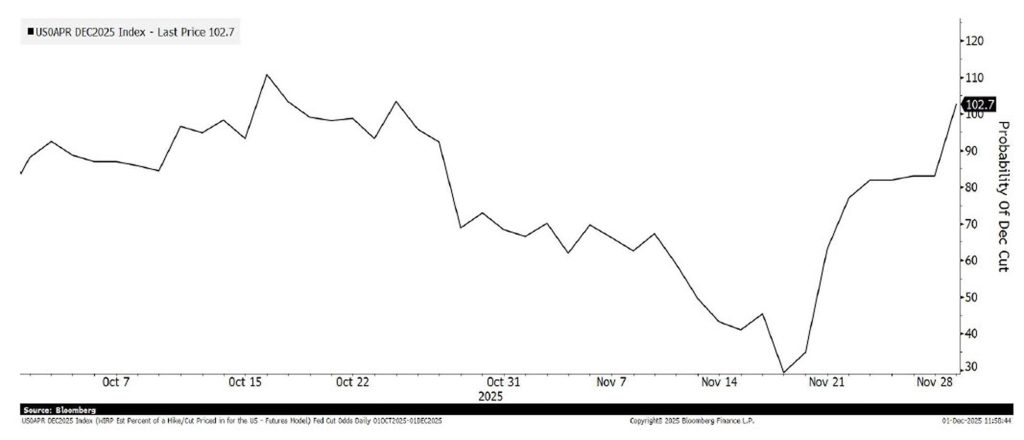

December Fed Rate Cut Odds

Late October through November saw a sharp pickup in volatility around rate cut expectations following the October 28-29 FOMC meeting (as detailed in the above chart), which delivered the widely anticipated 25-basis point reduction, lowering the federal funds target rate range to 3.75% – 4.00%. Markets had initially priced a December cut at ~100% – effectively treating it as a done deal – until Chair Powell pushed back firmly, declaring another move “not a foregone conclusion – far from it” and stressing the need for clearer data amid the ongoing economic data blackout due to the government shutdown. Hawkish commentary on sticky inflation quickly drove odds down to 29% within weeks. Yet, in the final days of November, probabilities rebounded back to ~100% after dovish remarks from New York Fed president and FOMC vice chair John Williams, who described current policy as “somewhat restrictive” and said there is “room to lower rates in the near term” to move closer to neutral – keeping a December cut in play. With the committee still split between inflation hawks favoring a pause and doves focused on labor market cooling, the whipsaw in futures pricing reflects the heightened uncertainty as the December meeting approaches.

The first major post-shutdown data arrived on November 20 with the long-delayed September jobs report, revealing Nonfarm Payrolls rose +119,000 – up substantially from August’s revised -4,000 loss and beating the +53,000 expected – indicating labor market resilience pre-blackout, despite the prior three months averaging under 30,000 jobs monthly. The unemployment rate edged up to 4.4% (from 4.3%), the highest since October 2021, while average hourly earnings rose 0.2% MoM and 3.8% YoY – below the 0.3% MoM and matching the YoY forecasts – signaling moderate wage growth pressures. In a separate release the same day, initial jobless claims for the week ending November 15 fell to 220,000 (down 8,000 from prior and below expectations), though continuing claims for the November 8 period rose to 1,974,000 (up from 1,946,000 and above forecasts), pointing to a mixed labor picture with no widespread deterioration yet. While the Q3 GDP release remains canceled, the Atlanta Fed’s GDPNow model – as of November 25 – projects 4.0% annualized growth, a slight pullback from 4.2% earlier in the month but still robust, underscoring potential strength from AI capex offsetting consumer softness. It is worth noting that the economic impacts of the government shutdown remain to be seen – the CBO is now estimating that Q4 GDP growth could be 1.5% lower than originally estimated – with each week of a shutdown subtracting approximately 0.1% from annualized GDP growth due to reduced government activity.

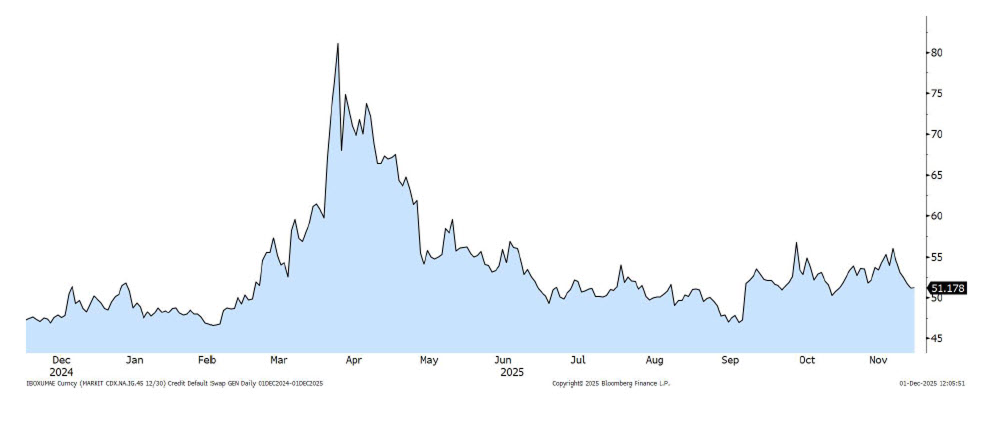

Financial Conditions

Credit spreads continue to hover near historic lows, signaling the U.S. economy’s underlying strength and resilience despite the recent government shutdown and data blackout. As market participants, the clearest gauge of credit risk comes from monitoring spreads – the extra yield demanded over risk free U.S. Treasuries – to compensate investors for default risk, liquidity risks, and sentiment. With markets being forward looking, widening spreads typically foreshadow downturns as caution builds, while tight spreads reflect investor confidence and appetite for credit risk. The 5-Year credit default swap index acts as a key synthetic proxy, aggregating sentiment for investment grade credits and revealing collective market pricing. With spreads staying relatively tight, investors remain willing to pay a premium for credit risk, highlighting cautious optimism amid delayed data and slowdown concerns.

Investment Outlook & Positioning

Our outlook remains steady: we expect Federal Reserve easing to persist into next year, gradually pulling both short and long-term yields lower. The yield curve remains inverted at the front end, with overnight rates exceeding 1–7-year UST yields even after the October rate cut, creating a delicate balance between capturing short-term yields and extending duration to lock in yields as rates continue to trend lower. In the current environment, monitoring incoming economic data and evolving Fed rate cut expectations has taken heightened importance due to the U.S. Government shutdown and the resulting economic data blackout. With key releases delayed/canceled, the usual flow of high-quality information that anchors market pricing has been temporarily severed. In the absence of recent data, Fed rate cut expectations have become unanchored and are swinging violently on every headline, rumor and private data point. As the “December 2025 Fed Rate Cut Odds” chart earlier in this commentary illustrates, markets have exhibited extreme volatility in recent weeks – these wild swings directly feed through to front end yields – impacting the space we operate in.

The current data blackout and violent swings in rate expectations only heighten the risk of abrupt repricing and policy error. That makes our long-standing emphasis on liquidity and high-quality assets more relevant than ever. Liquidity remains our strategy’s foundation, with core holdings in high-quality, highly liquid assets like bank deposits, money market funds, and short-term bond funds to enable flexibility. This foundation positions us to act on perceived value amid tight credit spreads and rising uncertainty. With credit spreads near historic lows, we remain selective, targeting investment-grade names in government mortgage-backed securities, callable agencies, asset-backed commercial paper, and fixed-to-float securities – prioritizing quality. As always, we continue to work directly with dealers to source new ideas as market conditions evolve.

US-FIT: Snapshot of Fund Facts

| US-FIT Pool Name | 30 Day Net Yield | 1 Month Net Return | 1 Year Return Annualized (%) | NAV Type |

|---|---|---|---|---|

| FL-FIT Cash Pool | 4.26% | 0.35% | 4.58% | *Stable |

| FL-FIT Preferred Deposit Pool | 3.78% | 0.31% | 4.29% | Stable |

| FL-FIT Enhanced Cash Pool | 4.42% | 0.47% | 5.12% | Floating |

| FL-FIT Select Cash Pool | 4.28% | 0.35% | 5.18% | Floating |

| TX-FIT Cash Pool | 4.27% | 0.35% | 4.61% | *Stable |

| TX-FIT Government Pool | 3.92% | 0.32% | 4.34% | Stable |

*As of November 30, 2025

Contact Information

Benjamin Streed, CFA

Chief Financial Officer

Dan Marro, CFA

Portfolio Manager

Vito Resciniti

Market Strategist

This presentation is only intended for institutional and/or sophisticated professional investors. This material is intended for informational purposes only and should not be relied upon to make an investment decision, as it was prepared without regard to any specific objectives, or financial circumstances. It should not be construed as an offer or to purchase/sell any investment. Any investment or strategy referenced may involve significant risks, including, but not limited to: risk of loss, illiquidity, unavailability within all jurisdictions, and may not be suitable for all investors. To the extent permitted by applicable law, no member of the Deep Blue Investment Advisors Team and/or US-FIT Trust or any officer, employee or associate accepts any liability whatsoever for any direct or consequential loss arising from any use of this presentation or its contents, including for negligence. This material is not intended for distribution to, or use by, any person in a jurisdiction where delivery would be contrary to applicable law or regulation, or it is subject to any contractual restriction. No further distribution is permissible without prior written consent.