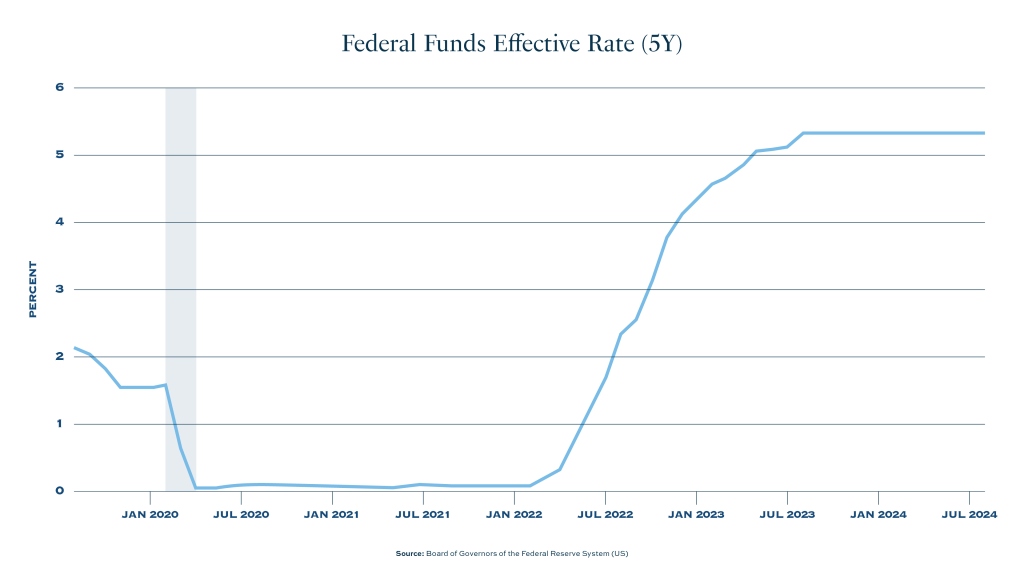

On September 18th, 2024, the Federal Reserve lowered rates by 50 basis points. This was a long-anticipated move the markets had desperately sought. This has a material impact on prudent positioning of liquidity investments given further rate cuts may also ensue. We will share insightful tips on how to most optimally invest in a falling rate market, but first offer a little helpful history about the Fed.

Created in 1913 with its primary purpose of enhancing the stability of the American banking system, the Federal Reserve System has made changes as to how it telegraphs to market participants the federal funds rate, the interest rate that banks pay each other to borrow or lend money overnight. By changing interest rates, thereby influencing the available money supply, the Fed can either help stimulate economic growth (accommodative) or slow it down (restrictive).

During Chairman Paul Volcker’s years at the Fed (early 1980’s), guidance was often directed to the market via open market operations that were conducted every day. The Fed would simply buy or sell U.S. Treasury securities on the open market to influence the Federal Funds rate. Often conducted via “intra meetings” held in between regularly scheduled Federal Open Market Committee (FOMC) meetings, kept markets on edge. The term “Fed watchers” became widely used for those economists who prided themselves on successfully predicting the Fed’s next actions. Crucially important to money managers was interpreting the Fed’s message and preparing their portfolios most optimally when rate changes occurred.

In 1987, Chairman Alan Greenspan changed the landscape by dictating to the markets what the general intent of the Fed was and how they were going to get there. Instead of second-guessing when, what direction and how much rates were going to change, the Fed started collaborating with the market and widely broadcasting their intent at regularly scheduled FOMC meetings. This sense of orderly communication enabled markets and participants to effectively plan for eventual changes in the amount and eventual direction of short-term rates, thus smoothing out ripples as a result of investors being caught off guard by interest rate shifts.

The Fed’s FOMC meeting schedule can be found here:

https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm

When the Federal Reserve eases rates and short-term interest rates are declining, investors can employ several strategies to potentially optimize returns and capture relative value in money market instruments. Here are some tips and strategies:

- Extend Maturities – This allows investors to lock in higher yields before further rate cuts. In an inverted yield curve, this may not seem a wise strategy, but if the Fed continues to lower rates, new issuance on very short-term securities (<30 days maturity) will fall more rapidly relative to longer-term securities.

- Actively Manage Duration – Like extending maturities, actively managing the duration of a short-term money market portfolio can help in capturing yield opportunities as rates decline. Instruments with a longer duration will tend to see greater price appreciation when rates decline. Selective allocation to longer-term local government investment pools (LGIPs) is one way to accomplish this efficiently and prudently.

- Optimize Liquidity Management – Declining rates can encourage a shift toward higher-quality, more liquid assets. However, maintaining some liquidity is crucial to take advantage of potential market dislocations or shifts in credit spreads. Investing in repurchase agreements (repos) and treasury repos for short-term liquidity needs, while allocating excess liquidity to higher-yielding instruments like agency securities or longer-dated CDs, can help maintain flexibility and more optimal liquidity management.

- Focus on Credit Quality – As rates decline, the spread between high-quality and low-quality issuers may narrow, but credit risk remains a concern, especially in economic downturns that might follow rate cuts. By prioritizing high-quality commercial paper, agency securities, U.S. Treasuries, municipals, and CDs issued by strong institutions, risk can be more optimally managed.

- Maximize Spread Capture – In a declining rate environment, spreads between different money market instruments may widen. Daily monitoring of the yield spreads between government-backed securities (e.g., T-bills, agencies) and private-sector instruments (e.g., commercial paper, CDs) is key, as allocation to instruments offering attractive risk-adjusted spreads is beneficial.

- Consider Agency Securities – Agency securities, such as those from Fannie Mae, Freddie Mac, or the Federal Home Loan Bank, often offer slightly higher yields than Treasury securities with minimal additional credit risk. Allocating a portion of the portfolio to agency securities with maturities that match the expected interest rate environment can provide a slight yield enhancement over Treasuries, especially as rates decline.

- Leverage Time Deposits – Time deposits, particularly those with longer maturities, may offer higher yields while also helping diversification among issuers to mitigate concentration risk.

- Monitor Central Bank Actions and Economic Indicators – Central bank policies and economic indicators provide critical clues about future rate movements and economic conditions. By watching the Fed communications along with economic data releases (e.g., inflation, GDP growth), and market sentiment, you can be better prepared for the unexpected.

These strategies may appear daunting, and that is why working with a professional Investment Advisor can be highly beneficial, save time, costs, and more optimally balance liquidity, credit risk, and duration. Active management in a local government investment pool or a separately managed account (SMA) provides a dedicated resource to helping you stay flexible and responsive to market conditions.

Summing it Up

At Deep Blue Investment Advisors, we focus daily on how much information the Fed provides currently compared to years past. Focused, discerning awareness and understanding of the Fed intentions coupled with implementation of solid plans of action is not only the objective and purpose, but also the hallmark, of Deep Blue Investment Advisors.

Our staff of professionals with decades of investment advisory experience, along with our constant involvement with markets, economists, and the flow of data, differentiates us. The ability to outsource this volume of activity is a critical component to the overall success of a CFO, finance director, treasury manager or investor’s workload. Key reasons to consider using an outside pool, SMA or advisory account are risk mitigation, liquidity optimization, time management, and pursuit of optimal returns.

The most crucial element of managing short-term cash for clients is the reduction of risk. Overwhelmed offices that conduct daily processes face potential increases in data errors, risk exposure or investment policy statement mistakes can result in losses or setbacks to the overall health and growth of an organization.

Secondly, the optimization of liquidity is a highly time-consuming function. The combination of liquidity management and supervision of other financial transactions is a daunting task. Monitoring cash flow and the timing of specific inflows and outflows are a critical part of this process about which we are happy to engage with our clients.

About Deep Blue Investment Advisors

At Deep Blue Investment Advisors, we specialize in helping government finance officers expand their horizons by diving into fixed-income management solutions with tangible results. Our team of experienced investment management professionals can help tailor a portfolio to your investment needs while providing regular reporting, portfolio compliance, and performance meetings. You can always count on us to prioritize our relationships, provide guidance, and act in your best interest.

To open an account or for more information, connect with one of our advisors today.

*This article was prepared by Deep Blue Investment Advisors (“Deep Blue”) for informational purposes only. Deep Blue makes no representation or warranty, expressed or implied, regarding the accuracy or completeness of the information contained herein. The report is not meant as a solicitation of any investment offered by Deep Blue. The US-FIT investments are not available for sale to the general public and only to certain qualified entities.

Investments in the US-FIT Pools are not insured or guaranteed by the FDIC or any other government agency. The investment pools may invest in fixed-income securities subject to risks, including interest rate, credit, and inflation. The investment return and principal value of an investment will fluctuate, so an investor may have a gain or loss when shares are sold.