Florida’s Economic Outlook: August 2023

Each month, economic expert Jerry D. Parrish, Ph.D. shares his insights on Florida’s current economic outlook with Deep Blue Investment Advisors.

One old joke about economists is that they have “correctly predicted 9 out of the last 5 recessions.” That’s funny, even to economists. We are trained to look at the negative news – and there has been plenty of that. But the economy continues to expand, and we’ve seen another positive data point for GDP growth recently.

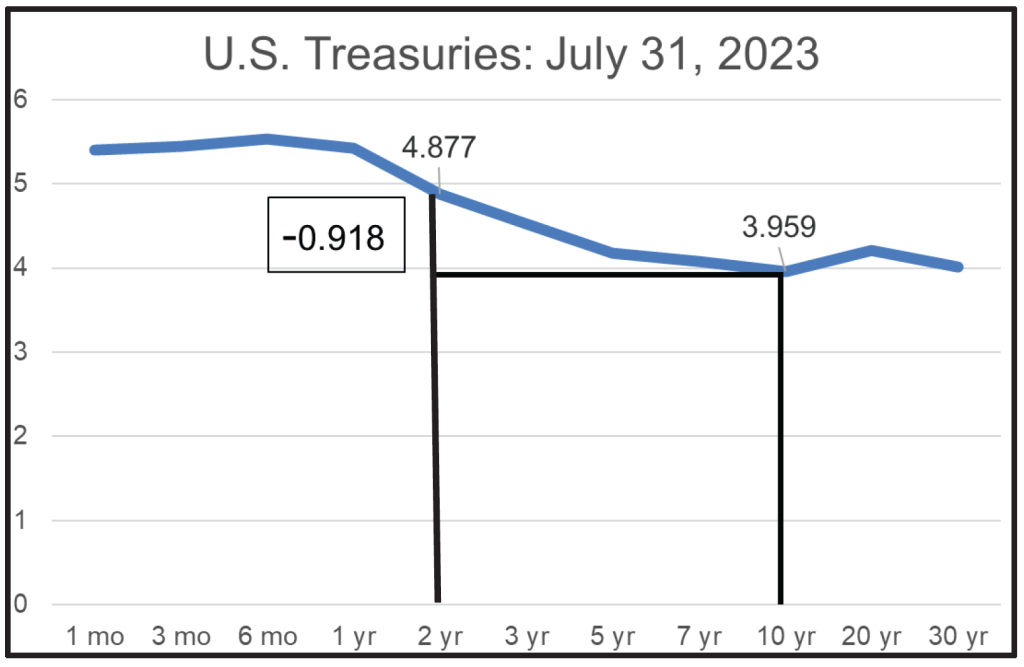

One reason that economists have been predicting a U.S. recession is the inversion of the yield curve. That happens when the short-term U.S. treasuries have higher interest rates than the longer-term treasuries.

As of July 31st, the 2-year treasury yield is 0.918 percentage points higher than the yield on the 10-year treasury. Historically, that’s a large inversion. The reason that economists watch the yield curve for inversions is that an inversion has been a reliable predictor of a recession for nearly 50 years. This pair of treasuries has been inverted since early July of 2022. That means that the inversion has been consistent for more than a year.

The reason that short-term rates are higher is that the Federal Reserve has been raising interest rates in an attempt to reduce inflation. The inflation rates in the U.S. have recently been at the highest level in over 40 years. The Federal Reserve sets the Federal Funds Rate, which was nearly zero through February 2022. Since that time, the Federal Funds Rate has increased by more than 500 basis points – or 5 percentage points. It is now at the highest level since 2006-2007.

The combination of the substantial increase in interest rates along with rising housing prices has slowed down housing purchases. But the economy continues to grow – with the most recent quarterly data shows an annualized GDP growth rate of 2.4 percent. Consumer spending and hiring have continued to increase since early 2020 when the COVID pandemic shut down much of the economy.

“The good news is that Florida should see a shorter and shallower recession than the U.S.”

So, will interest rates finally slow the economy enough to cause a recession? The jury is still out on that, because there is a possibility of the economy going into a soft landing. The Federal Reserve is likely to raise interest rates one more time and then watch to see how the previous interest rate increases are affecting the economy. The increase in interest payments on the U.S. debt of more than $31 trillion will have an effect on the budget of the United States. Other negative influences are that individuals with student loans will have to start repaying those loans shortly, taking some money out of the economy that would have been spent on consumer goods.

Although there is a possibility of a soft landing for the economy, the probabilities are that the U.S. will see a recession near the end of 2023 or in early 2024. The good news is that Florida should see a shorter and shallower recession than the U.S.

Economic Outlook is written by Jerry D. Parrish, Ph.D. Dr. Parrish is the Chief Economist and Direct of State and Local Policy Analysis at the Institute of Government at Florida State University.

The Economic Outlook is provided to you for informational purposes only. Deep Blue Investment Advisors (“Deep Blue”) makes no representation or warranty, expressed or implied, as to the accuracy or completeness of the information contained here. The report is prepared by an independent party believed to be reliable. No representation is made as to the accuracy or completeness. The report is not meant as a solicitation of any investment. To the extent permitted by applicable law, no member of the Deep Blue Team and/or Florida Fixed Income Trust or any officer, employee, or associate accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents, including for negligence. The information set forth herein is intended only for the person or entity to which it is addressed. The views expressed within this report constitute the author’s perspective at the dime of distribution and are subject to change. Any forecast, projection, or prediction of the market, the economy, and economic trends are based upon current opinion as of the date of issue and are also subject to change.