Florida’s Economic Outlook: June 2023

Each month, economic expert Jerry D. Parrish, Ph.D. shares his insights on Florida’s current economic outlook with Deep Blue Investment Advisors.

When the COVID pandemic hit the U.S. in early 2020, the U.S. economy saw drops in business activity and that resulted in layoffs for many companies. Some states were more affected than others because states had different policies and reopened their economies at different times.

This report looks at the recovery times for states to return their job numbers to pre-COVID levels. It also looks at which states have both recovered and increased job numbers the most. To start, we look at Florida and the other Southeastern states using data from the U.S. Bureau of Labor and Statistics.

“Florida led the way with the highest percentage increase in jobs—indicating not just the recovery to the previous job number, but also increases in job creation.”

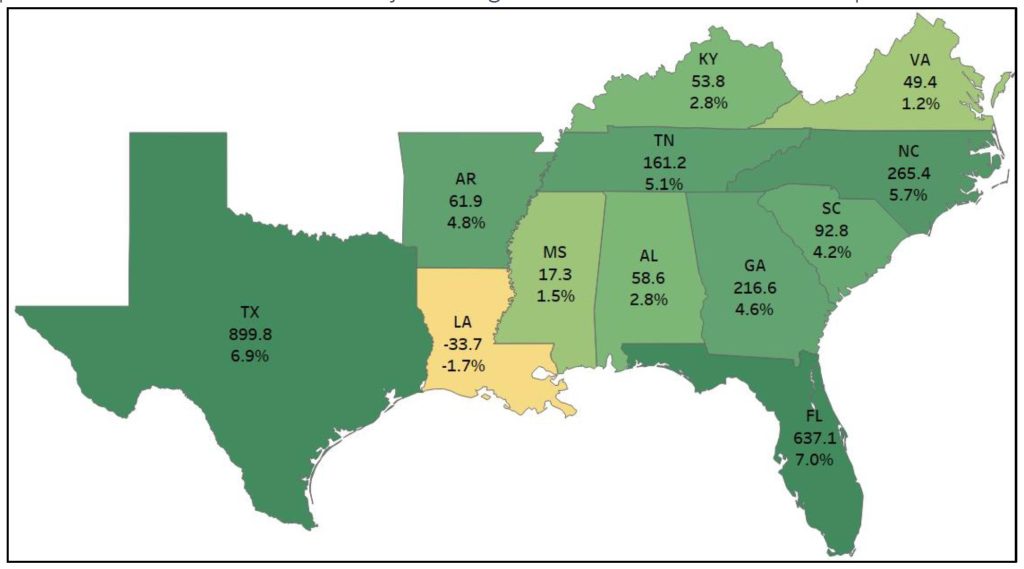

The map below shows the states from Virginia to Texas and how they have recovered from the pandemic recession. Below the state’s abbreviation is the change in the number of jobs, in thousands, since the pandemic began. The number below that shows the percentage change in total non-farm jobs. It is a heat map on percentage change—the darker the color, the higher the percentage increase. These are comparable numbers because they show seasonally adjusted data.

Florida led the way with the highest percentage increase in jobs—indicating not just the recovery to the previous job number, but also increases in job creation. Texas is solidly in second place—with a 6.9 percent gain and the largest number of jobs increased at 8999,800 jobs. North Carolina is in third place, with 5.7 percent more jobs than before the pandemic—an increase of 265,400 jobs.

Only one Southeastern state has failed to recover its jobs. Louisiana still has 33,700 more jobs to go to equal its previous job number.

You might be wondering how other high-population states have done in comparison to Florida. California has increased its job numbers by 356,400 jobs. That is an increase of 2.1 percent. Other large states haven’t done as well. New York still needs 165,700 jobs to get back to pre-COVID levels—that is a deficit of 1.7 percent. Illinois is in the same position, although it is closer to recovering. Illinois still needs 18,500 jobs to get back to the previous level—that’s a 0.3 percent deficit.

Dates of Recovery

The chart below shows the Southeastern states, along with California, New York, and Illinois and their dates they recovered to the same amount of non-farm jobs from before the pandemic recession. Leading states are Florida, North Carolina, Texas and Arkansas—all of them recovered in October of 2021, a full 9 months before the U.S. average. Virginia was the only state in the Southeast that recovered its jobs after the U.S.—and that was only one month later.

| State | Recovered | Compared to U.S. |

|---|---|---|

| Florida | Oct. 2021 | 9 months before |

| North Carolina | Oct. 2021 | 9 months before |

| Texas | Oct. 2021 | 9 months before |

| Arkansas | Oct. 2021 | 9 months before |

| Georgia | Nov. 2021 | 8 months before |

| Tennessee | Dec. 2021 | 7 months before |

| South Carolina | Jan. 2022 | 6 months before |

| Alabama | Feb. 2022 | 5 months before |

| Mississippi | Feb. 2022 | 5 months before |

| California | June 2022 | 1 month before |

| United States | July 2022 | |

| Kentucky | July 2022 | Same as U.S. |

| Virginia | Aug. 2022 | 1 month after |

| Illinois | N/A | Not yet recovered |

| Louisiana | N/A | Not yet recovered |

| New York | N/A | Not yet recovered |

Overall, states in the Southeastern U.S. have shown good recovery and job growth since the economic shocks of the COVID pandemic. That is a good indicator of their resilience to economic shocks, and may be a signal to how the Southeast may weather the expected upcoming recession.

Economic Outlook is written by Jerry D. Parrish, Ph.D. Dr. Parrish is the Chief Economist and Direct of State and Local Policy Analysis at the Institute of Government at Florida State University.

The Economic Outlook is provided to you for informational purposes only. Deep Blue Investment Advisors (“Deep Blue”) makes no representation or warranty, expressed or implied, as to the accuracy or completeness of the information contained here. The report is prepared by an independent party believed to be reliable. No representation is made as to the accuracy or completeness. The report is not meant as a solicitation of any investment. To the extent permitted by applicable law, no member of the Deep Blue Team and/or Florida Fixed Income Trust or any officer, employee, or associate accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or its contents, including for negligence. The information set forth herein is intended only for the person or entity to which it is addressed. The views expressed within this report constitute the author’s perspective at the dime of distribution and are subject to change. Any forecast, projection, or prediction of the market, the economy, and economic trends are based upon current opinion as of the date of issue and are also subject to change.